Different countries impose different kinds of taxes as a source of revenue for government expenditure. In Hong Kong, there are several types of taxes, and salaries tax is one of the income taxes levied by the Hong Kong government.

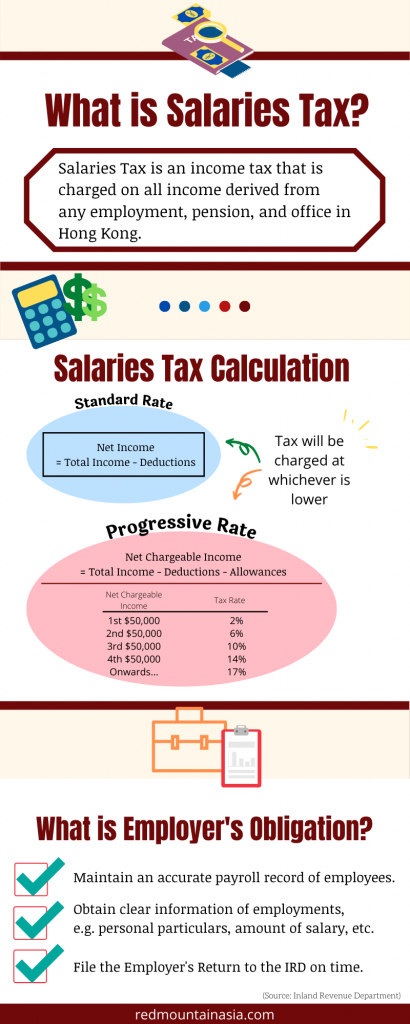

By definition, Hong Kong Salaries Tax is charged on all income derived from any employment, pension, and office in Hong Kong. On top of that, unrealized capital gain granted from an employee share scheme is also subjected to salaries tax. All taxpayers not only have to pay their respective tax, but they are also responsible for provisional salaries tax, which is computed based on their previous year’s liability.

Salaries Tax Calculation

So… How exactly is salaries tax computed in Hong Kong? As a matter of fact, Hong Kong is an interesting case as it charges at either, (i) Progressive rates on net chargeable income, or (ii) Standard rate on net income, for whichever is lower.

Progressive Rate

At the progressive rate, salaries tax is calculated based on the employee’s net chargeable income, where:

Net Chargeable Income = Total Income – Deductions – Allowances

In this equation, deductions include expenses like self-education expenses, charitable donations, tax-deductible MPF voluntary contributions, home loan interest, or any other expenses eligible to be deducted. Allowances are referred personal disability allowance, single-parent allowances, or other possible allowances claimed.

Once you’ve had your net chargeable income calculated, you can now move on to finding out how much tax you have to pay based on the progressive rate. For this method of taxation, taxes are calculated progressively at a different rate for every $50,000 you’ve earned:

Standard Rate

At Standard Rate, the calculation is a bit simpler, as it is charged at a constant rate of 15% based on the employee’s Net Income, where:

Net Income = Total Income – Deductions

Are There Any Tax Exemptions?

Hong Kong’s tax regulation is based on a territorial concept, which means any income derived from the territory of Hong Kong should be subjected to tax filing. Therefore, if you are a director or an employee whose duties and responsibilities are carried out in Hong Kong, and/or if you are working at a company that is resident in Hong Kong, the full income would be chargeable to salaries tax in the city.

However, there are tax exemptions and adjustments depending on the source of your employment. For example, if you, a non-Hong Kong resident, are assigned to perform duties in Hong Kong for several years by a non-Hong Kong employer, your salaries tax is only assessed based on your income attribute to the duties rendered in Hong Kong.

On the other hand, if you are hired by a Hong Kong-based company, your full income would be chargeable to salaries tax even if part of your duties are performed outside Hong Kong. But of course, exemptions can be claimed under certain circumstances.

As an employer, what is my obligation?

Employers carry a great amount of responsibility when it comes to salaries tax because the IRD (Inland Revenue Department) depends highly on employers regarding employee’s information and updates. Therefore, it is of utmost importance that employers keep an accurate and clear payroll record of their employee’s personal particulars, nature of employment, amount of salary, fringe benefits, the period of employment, and such, so that by the end of every fiscal year, employers have up-to-date employment information to file IRD’s Employer’s Return.

Who Can Help Relieve My Stress?

As a professional service firm with over 25 years of experience, we are here to ensure that your company is compliant with Hong Kong’s tax regulation, and that your Employers Returns are filed on time and accurately.

In order to do so, a clear staffing record of their work hours, salaries, and all other details are required. It is normal that companies find it hard to keep track, especially when their business scale expand. No worries, RedMountain Asia also provides a professional service called payroll outsourcing. What we do is that we help record your employment information so the daily operation of your business follows all sorts of payroll-related compliance.

We also have our HRIS (Human Resources Information System) called I-RED, which is an online tool to enhance HR payroll efficiency. Such a system allows 24/7 access, and the portal provides services like employee self-service, manager access, employee payslip, salary history, tax return, leave application, and such.

Salaries tax, payroll, and HR management have to work Interdependently all the time. We understand that not all employers have the time to manage paperwork like the annual employer’s return, yet, late submission might create a chance of penalty or even prosecution. That is why We, RedMountain Asia, are at your service.

(Source: Inland Revenue Department of Hong Kong)